Fringe Benefits Tax: What You Need to Know

Navigating the ins and outs of Australia’s fringe benefits tax (FBT) can be tricky. This concise guide provides a helping hand. Over the following pages, we provide a brief overview of FBT, touching on key areas such as benefits types, reporting dates, exemptions, Single Touch Payroll (STP), Not-For-Profit (NFP) concessions, FBT vs. allowances and tax gaps.

Disclaimer: This document contains general information and is also not intended to constitute legal or taxation advice. If you need legal or taxation advice, we recommend you speak to a qualified adviser.

What is a fringe benefit?

A fringe benefit is a benefit given to an employee or associate (typically family members) in respect of employment. It generally relates to non-cash items such as:

Private use of work cars

Entertainment (e.g. concert tickets)

Reimbursement of employees’ expenses (e.g. school fees)

Certain salary sacrifice arrangements

Some benefits are fringe benefits tax (FBT) exempt, either because of the benefit type or the employer category. The best way to find out what counts as a fringe benefit and what doesn’t is to talk to your tax adviser.

What is Fringe Benefits Tax (FBT)?

A fringe benefit provided to an employee incurs tax paid by the employer called fringe benefits tax (FBT). The FBT year is 1 April to 31 March – it is not the same as the financial year.

The current FBT rate is 47%, which is equal to the top individual marginal tax rate of 45% and Medicare levy of 2%. Employers must pay FBT at the rate on the “grossed-up” taxable value of fringe benefits.

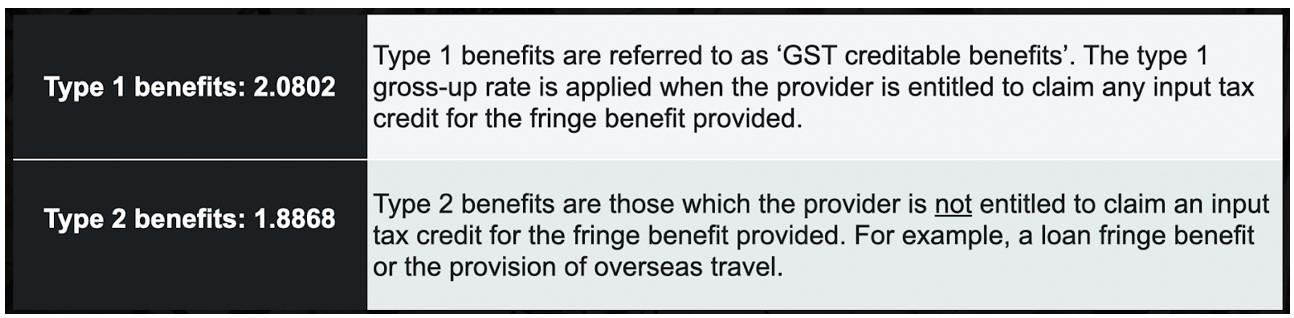

Grossed-up types

The below table sets out how to work out the grossed-up taxable value of fringe benefits:

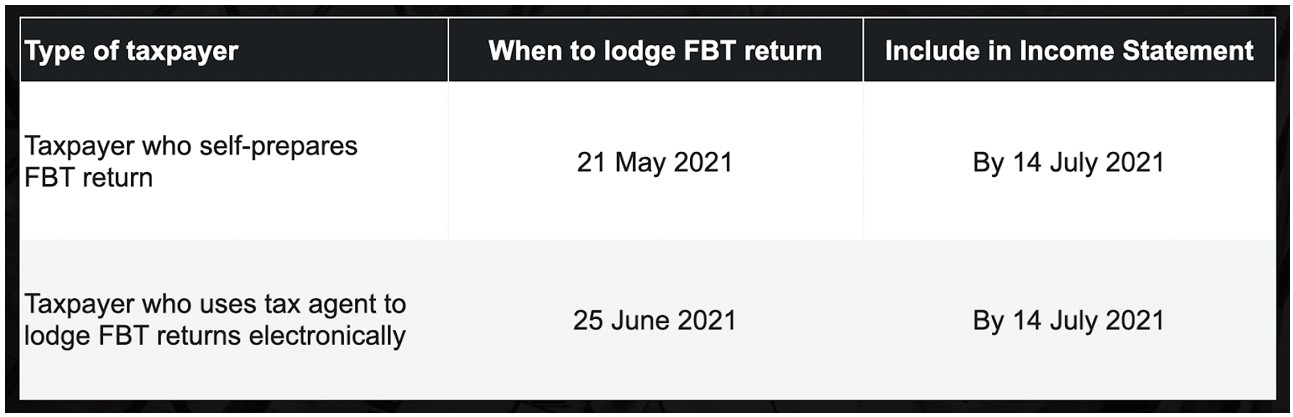

FBT reporting dates

FBT return lodgment is usually done by the company accountant or finance team at the end of the FBT year (31 March). The amount provided in this lodgment may need to be shown in the individual employee’s income statement at the end of the financial year (30 June).

FBT and Single Touch Payroll (STP)

The threshold for reporting the amount in the employee’s income statement is the cash value of the benefit if over $2,000. Grossed-up, the minimum amount reported this financial year would be $3,773.60. The Type 2 calculation method is always used for reporting fringe benefit amounts in the income statement.

FBT concessions for Not-For-Profits (NFPs)

FBT concessions include:

- FBT exemption

- FBT rebate

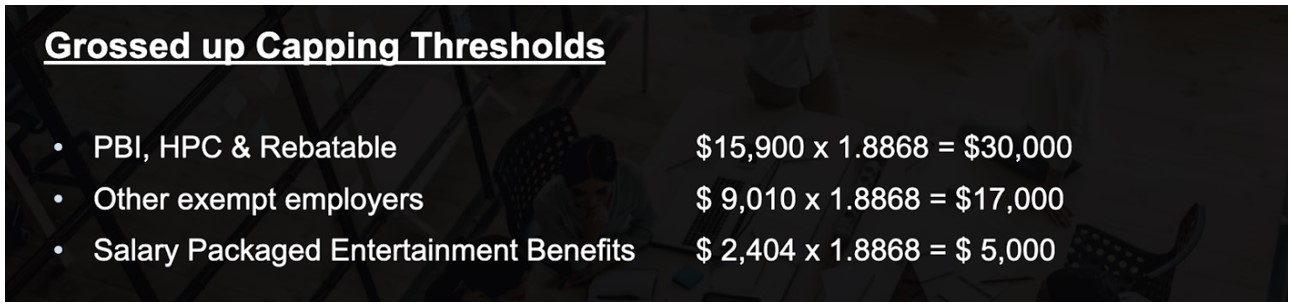

Public benevolent institutions (PBI), health promotion charities (HPC), public or NFP hospital and public ambulance service may be exempt from FBT up to capping thresholds. Other NFP organisations may qualify for the FBT rebate.

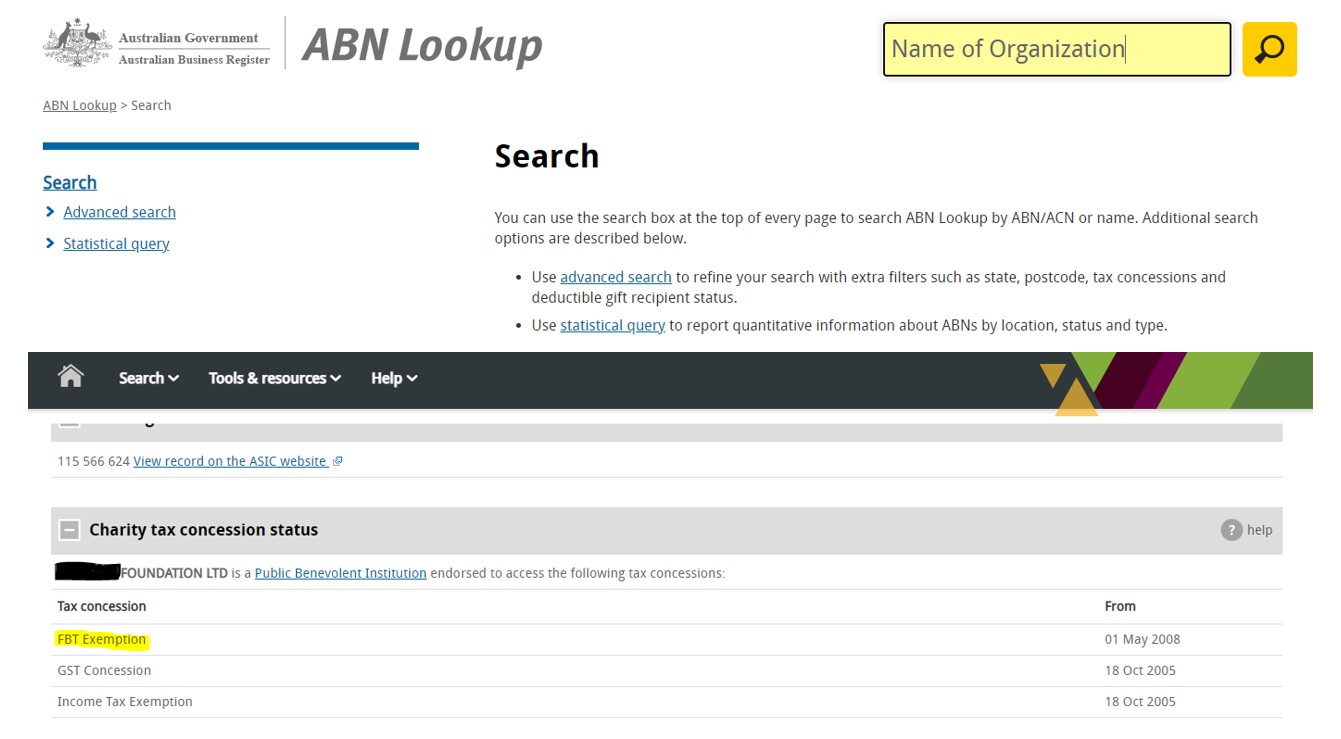

For concessions to apply, the NFP organisation must be registered with Australian Charities and Not-For-Profits Commission (ACNC) and be endorsed by the ATO. To find out if an organisation is exempt or rebatable, visit the ABN Lookup webpage here.

FBT exempt and relatable caps

Fringe benefits amounts in excess of the capping thresholds will incur the full fringe benefits tax amount. Even if an exemption or rebate applies to the capped benefits, the reportable fringe benefits rules still apply for taxable benefits over $2,000 ($3,773.60 RFB).

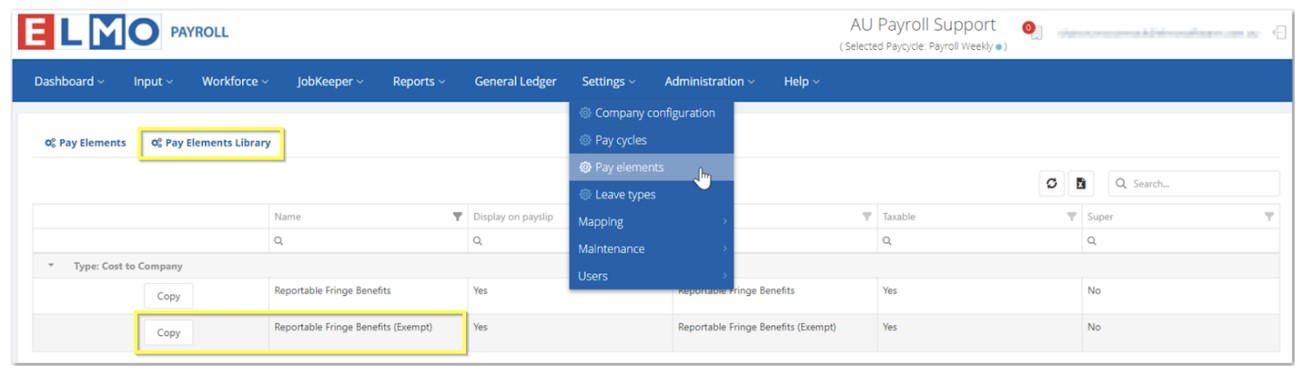

Reportable FBT Exempt Pay Element

To advise the ATO that the fringe benefits amounts being reported in the income statement have an exemption status, your software will need to allow nomination of this. Here is a sample of how one of ELMO’s products notifies the status at pay element level.

FBT or allowance?

Living-away-from-home-allowance (LAFHA) – FBT:

More than 21 days away from normal residence paid up to 12 months maximum. The tax-exempt parts of a LAFHA allowance are:

- Reasonable accommodations costs

- Reasonable food and drink costs (statutory rate is currently $42 per week for adults and $21 per week for children)

LAFHA rates are only taxable if the benefits exceed “reasonable” limits.

LAFHA thresholds:

Below is an excerpt from the 2021/22 LAFHA threshold table. For the full table visit the ATO LAFHA rates page here.

LAFHA Declarations

There are three types of forms for employees declaring the living-away-from-home allowance for different situations:

- Accommodation and food and drink expenses

- Employees who maintain an Australian home

- Fly-in fly-out or drive-in drive-out employees

Declarations are required before lodgment of the employer’s FBT return, or by 21 May following the FBT year end (31 March).

LAFH vs. business travel

Employees may be working under an Award or Enterprise Bargaining Agreement and may be provided with an allowance which is called a LAFH allowance. However, for FBT purposes, the allowance does not satisfy the conditions of a LAFH allowance and should be treated as a travel allowance.

TR 2021/1 Travel Expenses – Allowance

- No more than 21 days at a time away from “normal residence”

- An overall aggregate period of fewer than 90 days in the same location in an FBT year

- TD 2020/5 provides the reasonable amounts per region under the three salary brackets

Fringe benefits tax gaps

Car fringe benefits

The ATO will be focusing compliance action on:

- Car fringe benefits for small businesses (the ATO is data matching with external providers)

- Reportable fringe benefits are reported in employee payment summaries/income statements, but employer has not lodged FBT return

A fringe benefit may be provided where a car is available for the employee’s use even if the car is not driven by the employee.

Exempt motor vehicles

There are exemptions available for certain vehicles (e.g. panel vans and utes) where private use is limited to:

- Travel between home and work

- Travel that is incidental to travel in the course of employment duties

- Non work-related use that is minor, infrequent and irregular

There is no requirement to substantiate the FBT exemption for each individual vehicle. However, we recommend businesses put in place a policy that limits the private use of these vehicles for employees.

Fringe Benefits Tax – Key take-aways

- FBT is an employer liability but may need to be reported in employee income

- FBT year is a different date span to the financial year

- FBT requires a lot of record keeping

- Accountants require information provided by payroll

- Payroll teams need information provided by accountants

- Calculations may be on the purchased value of the benefit or the grossed-up value

- Some benefits may be allowances, not fringe benefits

For more in depth information about FBT, refer to the ATO website here.

This guide is based on an ELMO webinar in partnership with Findex. If you would like to hear more about Fringe Benefits Tax (FBT).

ELMO Software offers people, process and pay solutions in an all-in-one cloud-based platform. This includes recruitment, learning, performance management, payroll, expenses, and more. ELMO has helped thousands of organisations across Australia, New Zealand and the UK better manage, engage and inspire their people. For further information, contact us.

HR Core

HR Core