What is Prorated Salary and How it is Calculated?

Prorated salaries ensure you only get paid for the time you actually work. Let's dive into what prorated salary means and how it's calculated

A prorated (pro-rata) salary is a portion of a full-time salary that’s calculated based on the amount of time an employee works during a specific pay period. The adjusted salary you receive when you don’t work the entire pay period for various reasons.

Here are some common situations where you might encounter a prorated salary:

- Starting or ending employment mid-pay period: If you start a new job or leave one in the middle of a month, your first or last paycheck will be prorated based on the days you worked.

- Taking unpaid leave: If you take vacations, sick days, or other unpaid leave, your salary for that pay period will likely be prorated.

- Part-time employees: Since part-time workers don’t work the full standard workweek, their salaries are always prorated based on their scheduled hours.

The main idea behind prorating is to ensure fairness and equality. You only get paid for the time you worked, not the entire pay period.

How is prorated salary calculated in Australia?

Calculating prorated pay in Australia involves a few steps, and the specific method may vary depending on the situation and your employer’s chosen approach. However, here’s a general outline:

1. Factors to consider

- Employee’s annual salary: This forms the base for calculating their daily or hourly rate.

- Pay period duration: This could be weekly, fortnightly, or monthly, depending on the company’s policy.

- Total workdays in the pay period: This refers to the standard number of working days, excluding weekends and public holidays.

- Number of days worked by the employee: This is the actual number of days the employee worked during the pay period.

2. Choose your pro-rata calculation method

Daily rate method

Divide the annual salary by (52 weeks/year * 5 days/week) to get the daily rate. Multiply the daily rate by the number of days worked by the employee.

Example 1: Starting mid-month – Daily Rate Method

Scenario: An employee with an annual salary of $60,000 starts working on the 15th of a month with 20 working days. They work until the end of the month.

Calculation:

- Daily rate: ($60,000 / 52 weeks/year) / 260 days/year = $230.76

- Number of days worked: 20 days – 14 days (not worked) = 6 days

- Prorated Salary: $230.76/day * 6 days = $1,384.56

Therefore, the employee’s prorated salary for the month is $1,384.56.

Example 2: Taking unpaid leave – Daily Rate Method

Scenario: An employee with an annual salary of $40,000 takes 5 days of unpaid leave within a 20-day work month.

Calculation:

- Daily rate: ($40,000 / 52 weeks/year) / 260 days/year = $153.84

- Number of days worked: 20 days – 5 days (unpaid leave) = 15 days

- Prorated Salary: $153.84/day * 15 days = $2,307.6

Therefore, the employee’s prorated salary for the month is $2,307.6.

Hourly rate method

Divide the annual salary by the total number of work hours in a year (usually 365 * 8 hours/day or 260 * 8 hours/day, depending on the calculation basis). Multiply the hourly rate by the number of hours worked by the employee.

Example 1: Part-time employee – Hourly Rate Method

Scenario: A part-time employee has a contracted weekly salary of $400 for working 20 hours a week. They worked 16 hours in a specific number of weeks because of a personal absence.

Calculation:

- Hourly rate: $400/week / 20 hours/week = $20/hour

- Hours worked: 16 hours

- Prorated Salary: $20/hour * 16 hours = $320

Therefore, the employee’s prorated salary for the week is $320.

Annual-based method (365 or 260 days)

In Australia, the “annual based rate method” for prorating salary isn’t a commonly used term or method. However, there are two ways to calculate pro rata salaries based on annual income that are used:

Daily rate based on 260 working days

This method assumes 260 working days per year (excluding weekends and public holidays). Here’s an example:

Scenario: An employee with an annual salary of $75,000 worked 10 days in a 20-day pay period.

Calculation:

- Daily rate: $75,000 / 260 days/year = $288.46

- Number of days worked: 10 days

- Prorated Salary: $288.46/day * 10 days = $2,884.60

Monthly rate based on 12 months

This method divides the annual salary by 12 and then adjusts based on the actual days worked in the specific month. Here’s an example:

Scenario: An employee with an annual salary of $50,000 worked 15 days in a 20-day month.

Calculation:

- Monthly rate: $50,000 / 12 months = $4,166.67

- Percentage of months worked: 15 days / 20 days = 0.75

- Prorated salary: $4,166.67 * 0.75 = $3,125.00

Monthly-based method (calendar or working days)

The monthly-based rate method for prorated salary in Australia involves dividing the annual salary by 12 months and then adjusting it based on the actual days worked in a specific month. Here are two scenarios with different approaches:

Scenario 1: Using standard working days in the month

- Employee annual salary: $30,000

- Month with 22 working days

- Days worked: 16 days

Calculation:

- Monthly rate: $30,000 / 12 months = $2,500

- Percentage of months worked: 16 days / 22 days = 0.7273

- Prorated salary: $2,500 * 0.7273 = $1,818.25

Scenario 2: Using actual calendar days in the month

- Employee annual salary: $52,000

- Month with 31 days

- Days worked: 20 days

Calculation:

- Daily rate: $52,000 / (365 days/year * 12 months) = $38.46

- Prorated Salary: $38.46/day * 20 days = $769.20

3. Consider additional factors:

- Tax calculations and deductions: These still apply to prorated salaries.

- Company policy: Some companies might have specific guidelines or adjustments for calculating prorated pay. Consult your employer’s policy documents for details.

- Public holidays: If public holidays fall within the pay period, exclude them from the total workdays when calculating the daily rate.

Entitlement for prorated salaries

There are several situations where paying employees on a pro-rata basis is appropriate and necessary, as it ensures they receive fair compensation for the time they work. Not all employees are automatically eligible for prorated salaries. It depends on various factors, including:

1. Starting or ending employment mid-pay period

If an employee starts a new job or leaves their current one in the middle of a pay period, their first or last paycheck will be adjusted based on the number of days they worked. This prevents overpayment or underpayment.

2. Taking unpaid leave

When employees take unpaid leave for vacations, sick days, or other personal reasons, their salary for that pay period will be prorated to reflect the time they were absent. This ensures their regular salary is not impacted by the leave.

3. Part-time employees

Since part-time employees work fewer hours than full-time employees, their salary is always calculated on a pro-rata basis. This means their pay reflects the specific number of hours scheduled in their contract.

4. Changes in work schedule

If an employee’s work schedule changes within a pay period due to unforeseen circumstances, their salary might need to be prorated to reflect the actual hours worked. This might occur due to temporary project assignments, reduced workload, or other adjustments.

5. Bonus or commissions

In some cases, bonuses or commissions might be calculated based on performance during a specific period, and if that period is less than a full-time hours pay cycle, the bonus or commission may be prorated to reflect the actual work time.

6. Short-term contracts

While less common, some short-term contracts might stipulate pro-rated payments, especially if the contract outlines a fixed total payment regardless of specific days worked.

7. Company policy

Some companies may have specific policies outlining when pro-rata pay applies, even in situations not explicitly mentioned above. This could include situations like working overtime, taking temporary leave of absence, or participating in training programs.

Note that local regulations and company policies may influence the specific situations where pro-rata pay is mandatory or applicable. If you have any doubts about your specific situation, always consult your employer, HR department, or local labour authorities for an explanation.

Impact of a prorated salary on employee benefits

Prorated salary can impact employee benefits in several ways, depending on the specific benefit structure and company policies. Here’s a breakdown:

Type of benefits:

- Health insurance: Many companies offer health insurance plans with employer contributions based on full-time employment. Prorated salaries might result in lower employee contributions, potentially affecting coverage options or increasing out-of-pocket costs.

- Paid time off (PTO): Some companies accrue PTO based on hours worked or full-time status. Prorated salaries might translate to less PTO accrual, impacting vacation time or sick leave availability.

- Retirement plans: Some retirement plans require minimum contribution amounts or participation based on full-time status. Prorated salaries might affect entitlement or contribution levels.

- Other benefits: Some companies offer various benefits like dental insurance, vision insurance, or life insurance. The impact of these benefits can vary depending on the specific plan and company policy.

Company policy:

- Prorating benefits: Some companies might prorate benefits along with salary, while others might offer different policies, like fixed benefit amounts regardless of work hours.

- Minimum requirements: Some companies might have minimum work hours or salary thresholds for entitlement to certain benefits.

Local regulations:

Some countries or regions might have specific laws mandating minimum benefit coverage or access for employees even with short work periods.

Here are some general points to keep in mind:

- Review your employment contract and company policies: These documents should outline how prorated salaries affect benefits.

- Consult your HR department or benefits administrator: They can clarify specific details and guide your situation.

- Be aware of potential changes in coverage or costs: Prorated salaries can sometimes lead to higher out-of-pocket expenses for certain benefits.

- Plan ahead: If you anticipate a prorated salary period, consider adjusting your budget or exploring alternative coverage options if necessary.

Clear communication with your employer is key to understanding how your specific situation will be handled and ensuring you receive the benefits you’re entitled to.

Regulatory and legal principles for prorated salary calculations

In Australia, there are legal restrictions on prorated salary calculations in Australia to ensure fair and ethical treatment of employees. Here are some key points to remember:

Fair Work Act 2007

Minimum wage: The Fair Work Act outlines minimum wage requirements, ensuring even part-time and casual employees receive appropriate pay. This generally applies to the time they work, not necessarily prorated based on a full-time salary.

Overtime and penalty rates: The Act specifies overtime and penalty rates that apply when employees work longer than standard hours or on weekends/public holidays. These must be factored in, even for prorated salaries.

Leave entitlements: Employees accrue annual leave, personal leave, and other entitlements based on their ordinary hours of work. When taking paid leave, deductions should be calculated fairly, not simply prorating full-time salaries.

Superannuation guarantee (SG)

The law mandates employers to contribute a minimum percentage of employee OTE to their superannuation funds. OTE includes prorated salaries, and employers must ensure they contribute the appropriate amount based on the employee’s actual earnings during the pay period.

Payroll tax

Employers calculate payroll tax by considering an employee’s gross wages, including any prorated salaries. Employers need to ensure they accurately report and pay payroll tax based on the prorated amounts.

Remember, these are just key points, and specific legal requirements may vary depending on your situation and industry. It’s always best to consult reliable sources like the Fair Work Ombudsman or Fair Work Commission website for detailed information and explanation.

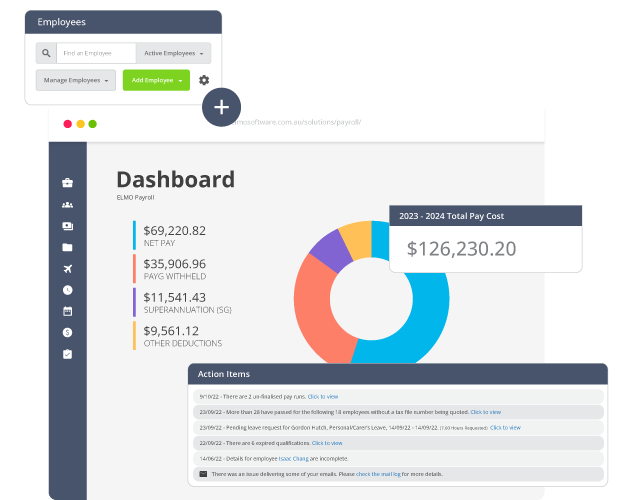

Payroll software helps automate pro rata wages

Payroll software can be a huge asset in automating pro-rata wages, saving time, reducing errors, and ensuring compliance with regulations. Here’s how:

Data integration

Payroll software integrates with timekeeping systems, automatically pulling employee work hours and attendance data. This eliminates manual data entry and potential errors.

Automated calculations

You can configure the software to use your desired calculation method (daily rate, hourly rate, etc.) and set rules for different pro-rata scenarios (starting/ending mid-period, leave, part-time). The software automatically calculates the correct prorated pay based on these rules and employee data.

Account for complexities

Payroll software can handle complex situations like variable work schedules, unpaid leave policies, different pay rates for overtime, and various deductions. It ensures accurate calculations even in intricate cases.

Compliance assurance

The software automatically calculates taxes and deductions according to Australian regulations, ensuring compliance with relevant laws and avoiding penalties.

HR Core

HR Core