Payroll Transparency: Building Employee Trust and Engagement

Payroll transparency has become an increasingly important topic in today’s workplace. The company is transparent about how it decides employee salaries. As issues of pay equity and fairness dominate headlines, many employers are discovering the benefits of increased openness and communication around compensation.

Implementing payroll transparency practices can strengthen trust, morale, and engagement between managers and employees. Staff who understand the pay decision process are less prone to confusion and resentment about their salaries. Transparency allows companies to better align pay structures with their values and culture.

Benefits abound for both sides of the equation:

- Employers: Hire the best people, treat them fairly, and keep them happy. This builds a strong reputation, boosts productivity, and stops people from leaving.

- Employees: Understand their career trajectory, make informed career decisions, negotiate with confidence and experience greater work satisfaction when they feel properly valued and rewarded.

Discover best practices for HR professionals and managers looking to improve salary information.

Why implement salary transparency?

In the age of open communication and employee empowerment, opaque payroll practices are becoming increasingly outdated and detrimental. But beyond ethical considerations, embracing payroll transparency can unlock real business benefits, boosting employee morale, performance, and retention. Let’s explore both sides of the coin:

The negative side of opacity:

- Confusion and frustration: Confused paychecks mean frustrated workers who don’t trust the boss. Imagine deciphering a cryptic pay statement filled with jargon and unexplained deductions.

- Distrust and resentment: When pay feels unfair or arbitrary, resentment festers. Opaque practices can create suspicion of playing favourites or bias, leading to a negative work environment and discouraging employees.

- Legal Risks and compliance issues: Not telling people how much jobs pay or treating them unfairly can get you in trouble in some places.

Pay Transparency

- Improved morale and satisfaction: Seeing a link between performance and pay feels like a pat on the back. This leads to increased morale, satisfaction, and a more positive work environment.

- Boosted performance and retention: Openness builds trust and makes people feel involved, so they care more about their jobs and stay longer. It empowers them to chase career goals and see a clear path for advancement.

- Competitive edge in talent acquisition: In today’s competitive job market, transparency is a selling point. Openly communicating compensation policies and salary ranges attracts top talent who value fairness and clear communication.

Ethical and legal considerations:

- Fairness and equity: Open pay practices reward hard work and performance, not random things. This aligns with ethical principles and reduces potential discrimination claims.

- Compliance and legal protection: Keep things clear, stay on the right side of the law, and build a secure workplace.

Implementing payroll transparency isn’t just about good intentions, it’s about building a stronger, happier, and more productive workforce.

Building a transparent payroll system

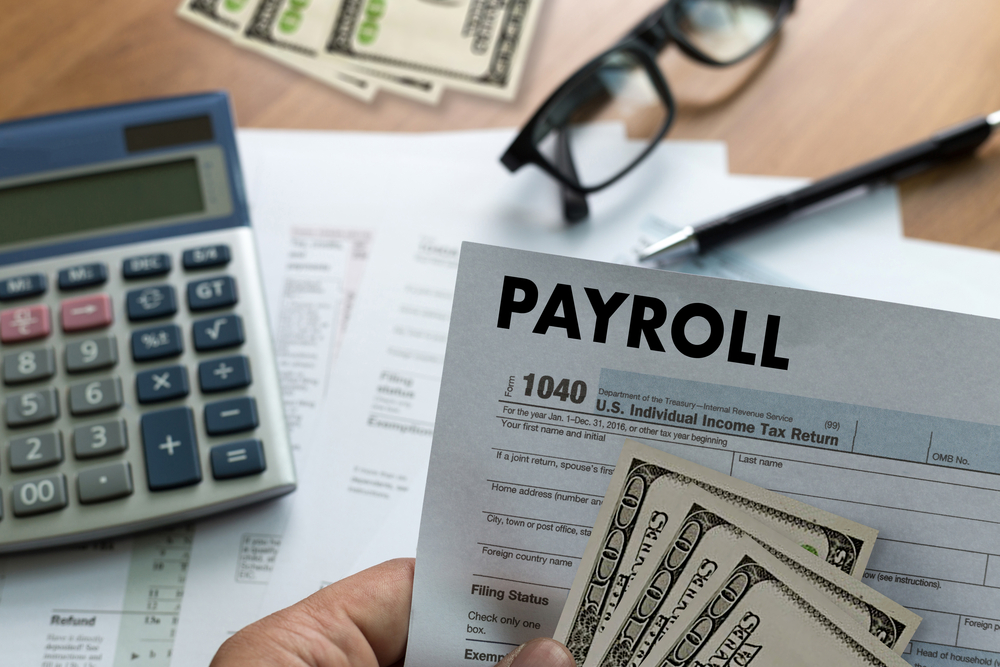

Payroll is more than just a number on your paycheck. The tangible reward for your hard work and dedication. Unfortunately, many employees navigate payroll systems with confusion and even suspicion. This is where building a transparent payroll system comes in, fostering trust and fairness through clear communication and openness.

1. Breakdown of paycheck:

A transparent system starts with a clear and detailed breakdown of your paycheck. This includes:

- Gross pay: Your total pre-tax earnings for the pay period.

- Deductions: Items withheld from your paycheck, like taxes, health insurance, and retirement contributions. Explain each deduction clearly and even provide links to relevant information resources.

- Taxes: Help me understand the breakdown of my withheld federal, state, and local taxes. Consider offering plain-language explanations of complex tax terms.

- Net pay: Your income after accounting for deductions

Go beyond just numbers. Use clear labels, explain unfamiliar terms, and even offer examples of payslips with annotations. Remember, transparency isn’t about jargon, it’s about empowering employees to understand their compensation.

2. Communication & explanation:

Clear and consistent communication is key to building trust. This means:

- Employee meetings: Regularly hold meetings to explain payroll policies, answer questions, and address concerns.

- FAQs: Get clear, concise answers to common questions about money matters.

- Online resources: Offer easy-to-access online resources, like payslip explainers and benefit plan overviews.

Explaining complex topics:

- Taxes: Use simple language, avoid jargon, and provide links to relevant tax authority websites.

- Benefits: Offer short explainer videos, written guides, and one-on-one consultations with HR representatives.

Simplify the complex. Use clear language, avoid technical jargon, and provide visuals like charts or infographics. Remember, the goal is for everyone to understand, regardless of their financial expertise.

3. Open dialogue & feedback: Building a two-way street

Transparency isn’t just about sharing information; it’s about creating an open environment for feedback. Encourage employees to:

- Ask questions: Create a culture where asking questions about payroll is encouraged, not discouraged.

- Voice concerns: Have a mechanism for employees to privately raise concerns or issues with the payroll system.

- Provide feedback: Conduct surveys or use suggestion boxes to gather feedback on payroll processes and areas for improvement.

Transparency is an ongoing journey. Building a trustworthy payroll system starts with listening. By making these changes and inviting your input, we’re on the path to success. This means less confusion, happier people, and a more engaged workforce.

Tools and resources for payroll transparency

Building a transparent payroll system requires more than just good intentions. It’s about equipping yourself with the right tools and resources to make it happen. Here’s your toolkit for HR professionals in Australia:

1. Payroll software with detailed reporting features:

Ditch the spreadsheets and invest in payroll software that shines a light on payroll data. Look for features like:

- Employee self-service portals: Empower employees to access payslips, tax information, and deductions digitally.

- Detailed payslips breakdowns: Ensure payslips clearly explain gross pay, deductions, net pay, and unfamiliar terms.

- Custom reporting tools: Generate reports for different purposes, like evaluating compensation trends or identifying potential pay discrepancies.

2. Templates for clear and concise payslips and communication materials:

- Fair Work Ombudsman (FWO): Provides free downloadable payslips templates that comply with Australian regulations.

- Workplace Gender Equality Agency (WGEA): Offers resources and templates for communicating about gender pay gap data.

- Australian Payroll Association (APA): Members have access to a library of resources, including payslips templates and communication guides.

3. Training materials on payroll transparency best practices:

- FWO: Provides online training modules on payroll transparency, including best practices for communication and reporting.

- APA: Offers webinars and workshops on various payroll topics, including transparency and compliance.

- Chartered Accountants Australia and New Zealand (CA ANZ): Access resources and training on transparency and best practices.

4. Links to relevant legal and regulatory information in Australia:

- Fair Work Act 2007: Outlines employee rights to request and access pay information.

- Fair Work Ombudsman: Provides information on payroll transparency requirements and best practices.

- Australian Taxation Office (ATO): Offers resources and information on payroll taxes and reporting obligations.

Overcoming challenges to pay transparency

Embracing payroll transparency is a powerful move, but let’s face it, it’s not without its challenges. Concerns about sensitive information, managing individual emotions, and potential pushback are all natural. Challenges for pay disparities can be overcome with the right approach.

Acknowledging the challenges

- Data security: Protecting employee pay information is paramount. Ensure your systems are secure with strong passwords, encryption, and access controls.

- Individual concerns: Some employees may feel uncomfortable sharing their pay details, even privately. Respect individual privacy preferences and provide opt-out options.

- Addressing disparities: Transparency can expose pay discrepancies. Be prepared to address concerns fairly and proactively, focusing on objective performance data and compensation policies.

- Communication & change management: Transitioning to transparency requires clear, consistent communication. Address employee concerns openly and honestly, and be transparent about the process.

Practical tips for success

- Highlight data security: Invest in robust data security measures and regularly update your systems. Communicate your data security practices to build trust.

- Offer multiple options: Provide various levels of transparency, allowing employees to choose what information they share. Consider unnamed salary ranges or bandings.

- Focus on fairness: Tell us in plain language how employees get paid. Is it based on how well they do their job and how much experience they have?

- Communicate proactively: Be open and honest about the reasons for implementing transparency and its potential benefits. Address concerns head-on and create a safe space for dialogue.

- Seek expert guidance: Consider seeking guidance from HR professionals, legal advisors, or payroll software providers to navigate complex issues.

Transparency is a journey, not a destination. Be patient, address challenges constructively, and use feedback to constantly improve your approach. Make security, privacy, and open communication your priorities to create a trusting and fair company.

HR Core

HR Core