How HR Can Become a Friend of Finance

Looking to get sign-off on your HR technology investments? You are not alone. Of all the insights to emerge from the National HR Summit, held recently in Sydney, one that struck the strongest chord, and was mentioned repeatedly over the course of 2 days, was HR’s relationship with finance. In many cases it’s been a tumultuous relationship, with both sides at loggerheads over just about everything – but especially budgets.

The HR/finance relationship is important for 3 key reasons:

- CFOs often have the final approval of HR projects

- They are a trusted advisor to the CEO

- In some organisations, the CFO is directly responsible for HR and related areas like training

As suggested by event speakers from companies as diverse as Facebook, Uber and Siemens, this relationship has always been fraught. CFOs have tended to view human capital as a cost, whereas CHROs have viewed it as an asset that requires investment.

However, an organisation’s people actually exist at the junction between both those spheres and HR data has helped narrow the gap between the two.

Today, the ROI of HR initiatives, gained through meaningful metrics, has helped to paint a more rounded view of HR’s value to the business, especially in relation to employee retention, productivity and engagement. This data can be used to forecast ahead, anticipate threats and add value during times of change (such as during a merger or acquisition).

In response to an audience question at the Summit about how HR can take the lead on workforce strategy, Diana Nadebaum, Chief People Officer at Opteon, said HR must become a “Friend of Finance”, or FOF, if it wants to continue to add value at the executive table.

So, what’s the key to a successful HR/finance partnership? Nadebaum said interpersonal skills are critical – not just for the relationship with the CFO or Head of Finance, but for connecting with others who will “fight the fight” on your behalf or will at least support your argument. She suggested HR go “behind the scenes” to demonstrate first-hand to potential supporters why HR’s suggestions – whether it relates to additional headcount, new technology, or why learning & development is critical to staff retention – are worth backing. “Use return on investment stats and data to build advocates,” she suggested. “Understand what the potential benefits to the organisation are – and present numbers to back this up. This is the language of business.”

What metrics matter?

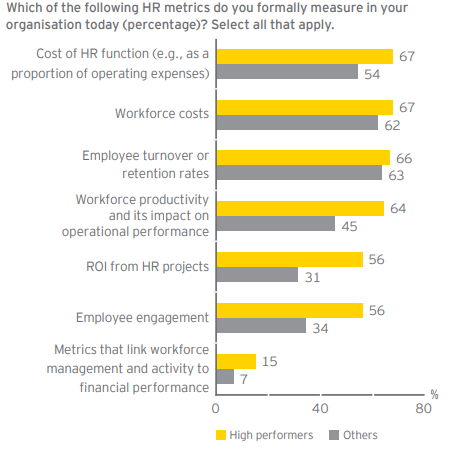

EY’s white paper, “Partnering for Performance: The CFO and HR”, surveyed 550 CFOs and CHROs. Respondents were asked which HR metrics are formally measured. The results were divided into 2 categories: those organisations deemed “high performers”[1] and all others. The graph below provides a snapshot of what HR metrics are being reported in successful organisations.

It’s not all about numbers – but they naturally play an important role in the HR/finance relationship. Here are 5 tips to ensure you’ve got the ear of your CFO.

- Invest in time. CFOs and CHROs at high-performing organisations invest the time needed to make the relationship work. EY’s research,[2] suggests at high performing organisations these 2 colleagues will spend 7.8 hours together (verses 5.1 hours in other organisations) per week . During their time together, they seek out common ground on business issues. It’s critical to note that in these organisations, both the finance and HR departments have migrated administrative tasks to shared services and created centres of excellence. Alternatively, they’ve automated these tasks – freeing up time for senior staff to collaborate.

- Look to the future. Sure, you don’t want to ignore the present or the past, but 37% of CHROs and CFOs in high-performing organisations say the relationship is primarily forward-looking, rather than backward-facing (verses 19% in other organisations). They work together to identify challenges and threats and work on solutions to get the most out of people and capital. In addition, they have the confidence to identify and propose solutions that achieve strategic objectives within appropriate financial and people parameters.

- Ensure HR knows the numbers. 49% of high-performing organisations consider themselves to be excellent at using data analytics to improve HR performance (verses 23% in other organisations). In these organisations it’s not just up to HR; the CFO is heavily involved in identifying and tracking HR metrics. EY’s research suggested there were several key areas where analytics can be used to improve performance, including:

- Managing attrition. Using predictive analytics, organisations can reduce attrition by examining behaviour and communication patterns to create a better understanding of employee engagement and to spot early signs of burnout or low productivity.

- Identifying hidden potential. High-performers can be identified by analysing patterns of communication. This helps organisations to spot individuals who both receive and send a lot of information, suggesting that other team members seek them out for advice, and that they make a strong contribution by providing information themselves.

- Strengthening talent processes. Recruitment and succession decisions are prone to biases and human error. By combining traditional recruitment processes with the use of workforce analytics to screen potential employees, organisations can improve hiring decisions, which ultimately leads to higher retention rates and increased productivity.

- Meet business challenges from both sides. Considering the people and finance implications in parallel increases the chances that the right decisions get made at key moments, such as before and during major transformation projects or new product and service developments. HR can answer questions that finance might have about the workforce and track the data that improves the decisions being made. Remember, most HR data has traditionally been what’s easiest to measure, not what is most important. HR should be identifying and monitoring the workforce KPIs that will support any strategy and then be prepared to create the story behind the stats – otherwise known as qualitative storytelling.

- Get involved in strategy, not just implementation. Organisations make better decisions when finance and HR provide input into corporate strategy, rather than just being involved in its implementation. The key to this, of course, is workforce analytics. HR today has the ability to apply these insights to areas such as strategic workforce planning, and operational and workforce performance modelling. If that doesn’t catch your CFO’s attention, nothing will.

On the same page

A common misconception is that CFOs are from Venus and CHROs are from Mars, and never the twain shall meet. However, the reality is different. CFOs are very aware of how important effective HR operations are to business success. When Deloitte surveyed CFOs in the second quarter of 2017, their top internal concern was securing and retaining the right talent – ahead of driving change, cost control, operational execution, and risk. In the Q2 2018 survey, CFOs cited talent shortages among the greatest external obstacles to company growth.

HR can meet finance half-way by understanding business metrics outside of their usual realm and speaking the language of business. Only then is there a chance the 2 parties can be Best Friends Forever…or if not forever, most of the time.

Building a business case for HR technology investment? Try ELMO’s easy-to-use ROI Calculators for Recruitment, Onboarding, Performance Management, Learning Management Software (LMS), Payroll to see how much time, resources and money your organisation could potentially save by automating administrative HR tasks with ELMO solutions. Alternatively, contact us to learn more about our integrated suite of cloud-based HR, payroll, rostering / time & attendance solutions.

[1] EY defined a high-performing organisation as one that: achieved earnings before interest, taxes, depreciation and amortisation (EBITDA) growth over the past 12 months of 10% or greater; or one that has seen a significant improvement in employee engagement and employee productivity over the past 3 years.

[2] “Partnering for Performance: The CFO and HR” white paper by Ernst & Young.

HR Core

HR Core